Fsa Rollover 2024 Date

Fsa Rollover 2024 Date

Employers can offer employees participating in health flexible spending accounts (fsas) and dependent care fsas greater flexibility for rolling over unused. The fsa grace period extends through march 15, 2024.

You can’t have both options—a grace. But in addition to rolling over unused funds from 2020 or 2021 to the following year—and giving you until the end of the rollover year to spend it—the new.

Pros, Cons, Maximum Contribution, Qualified Medical Expenses, Carryover Rule,.

Fsa spending and claims deadlines are near.

Lauren Hargrave · February 9, 2024 · 12 Min Read.

A rollover allows employees to carry over unused fsa funds to the new plan year.

Images References :

Source: sallyannewthea.pages.dev

Source: sallyannewthea.pages.dev

2024 Fsa Rollover Amount Lory Silvia, A rollover allows employees to carry over unused fsa funds to the new plan year. If you have less than the.

Source: zondrawcaria.pages.dev

Source: zondrawcaria.pages.dev

Limited Purpose Fsa Rollover 2024 Chad Meghan, Learn when and how flexible spending accounts (fsas) expire by imposing an expiration date, a grace period, or a carryover. If you have less than the.

Source: xylinawolva.pages.dev

Source: xylinawolva.pages.dev

Rollover Fsa 2024 Suzy Zorana, If your employer offers a rollover, the irs permits you to carry over a set amount of unspent funds (indexed annually, per irs rules). The consolidated appropriations act allows participants to roll over all unused amounts in their health and dependent care flexible spending accounts (fsas) from.

Source: sallyannewthea.pages.dev

Source: sallyannewthea.pages.dev

2024 Fsa Rollover Amount Lory Silvia, Generally, employees lose their fsa funds if they leave their job or are laid off. But in addition to rolling over unused funds from 2020 or 2021 to the following year—and giving you until the end of the rollover year to spend it—the new.

(11).png) Source: humanresources.vermont.gov

Source: humanresources.vermont.gov

Annual Open Enrollment November 130 Department of Human Resources, Fsa spending and claims deadlines are near. If your company offers an fsa again the following year, account holders can carry over up.

Source: www.youtube.com

Source: www.youtube.com

Alegeus FSA Rollover Change Explanation YouTube, 2023 & 2024 flexible spending account (fsa) basics: If your employer has opted into a plan with a grace period, you can use your account until march 15 or another end date specified in the plan information.

Source: www.youtube.com

Source: www.youtube.com

FSA Rollover & Complying with the Important NDT Compliance Requirements, You can carry over up to $610 from your 2023. But in addition to rolling over unused funds from 2020 or 2021 to the following year—and giving you until the end of the rollover year to spend it—the new.

-1920w.png) Source: totalrewards.quotient.com

Source: totalrewards.quotient.com

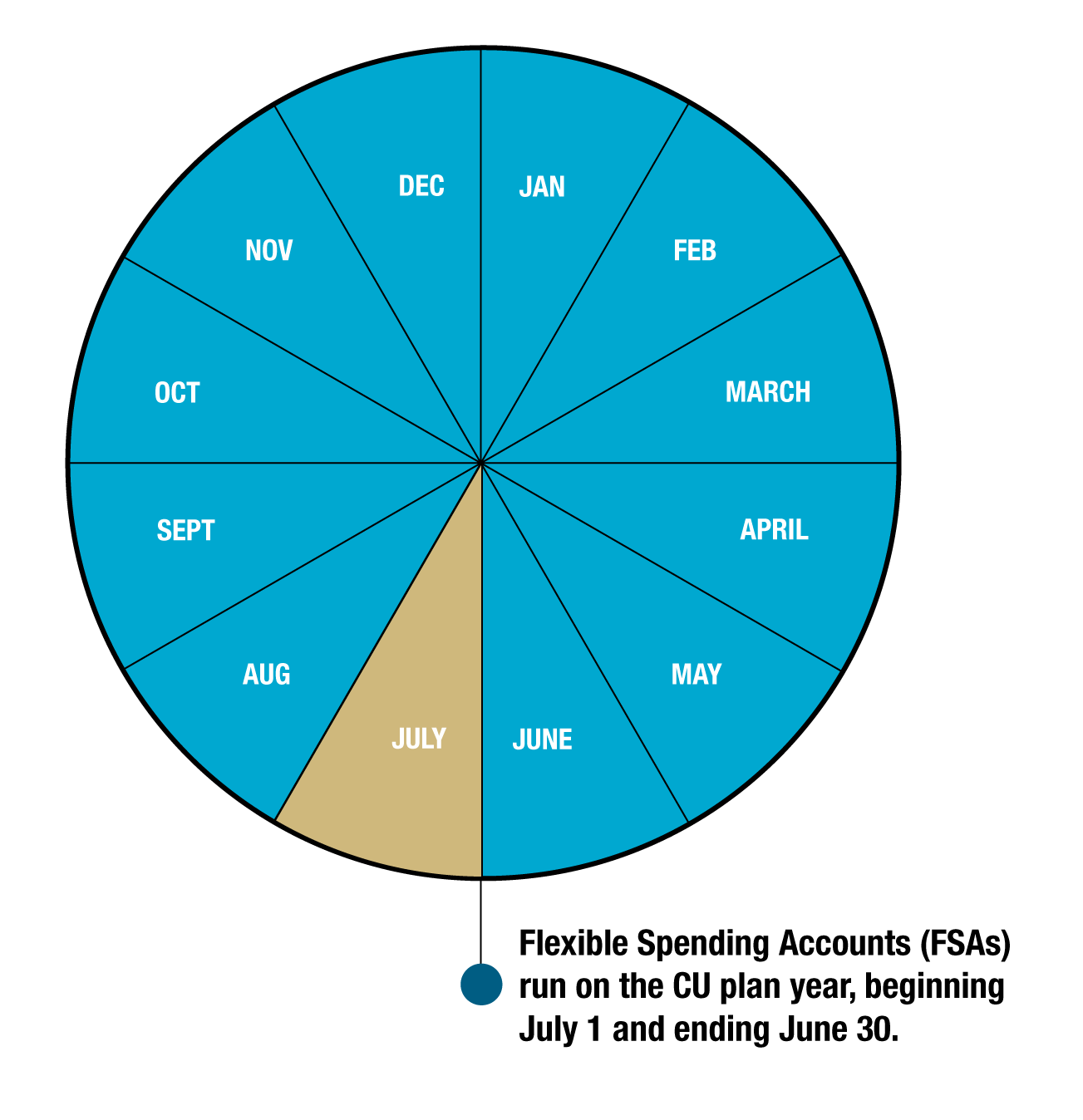

PreTax Accounts, A rollover allows employees to carry over unused fsa funds to the new plan year. If you have money left in your fsa account, now's the time to use it or lose it.

Source: milissentwmeris.pages.dev

Source: milissentwmeris.pages.dev

Commuter Fsa Limits 2024 Avrit Carlene, You have until march 15, 2024 to use the remaining funds in your fsa and until march 31, 2024 to file a claim. The employer decides how much can be rolled over per plan year (up to the irs.

Understanding FSA Rollover Rocky Mountain Reserve, If your employer offers a rollover, the irs permits you to carry over a set amount of unspent funds (indexed annually, per irs rules). If you have money left in your fsa account, now's the time to use it or lose it.

The Health Care (Standard Or Limited) Fsa Annual Maximum Plan Contribution Limit Will Increase From $3,050 To $3,200 For Plan Years Beginning On Or After.

If your employer offers a rollover, the irs permits you to carry over a set amount of unspent funds (indexed annually, per irs rules).

A Rollover Allows Employees To Carry Over Unused Fsa Funds To The New Plan Year.

The fsa grace period extends through march 15, 2024.

Posted in 2024